Recently, Congress passed the Covid-19 stimulus bill. There are many pieces of the bill, and we’ll only cover the State, Tribal, and Local Government segment of the bill.

To give an overview, the bill’s name is the Coronavirus Aid, Relief, and Economic Security Act (CARES), and it provides an estimated $2 trillion stimulus to battle financial hardships from the horrible pandemic we are facing. The $2 trillion is broken into the following categories:

- $150 billion for state, local and tribal governments

- $30 billion for education

- $45 billion for disaster relief fund for the immediate need of state, local, and tribal and territorial governments to protect citizens

- $1.4 billion for deployment of national guard

- $4.3 billion for the centers for disease control and prevention

- $25 billion for transit systems

- $400 million in election security grants

- $500 billion lending funds for business, cities, and states

- Provides a $1,200 direct payment to many Americans and $500 for each dependent child.

Per the lao.ca.gov website, the State of California will be receiving $15.3 billion of the $150 billion. Local governments in California will receive $5,808.6 billion. The allocation is based on population. Next let’s review the requirements to receive these funds for local governments.

Below shows the requirements:

- The population of the local government must exceed 500,000. If your local government does not exceed this amount, you are not eligible to request any funding.

- The local government must incur the following expenditures to be eligible:

- Are necessary expenditures incurred due to the public health emergency with respect to the Coronavirus Disease 2019 (COVID-19)

- Were not accounted for in the budget most recently approved as of the date of enactment of this section for the state or government

- Were not accounted for in the budget most recently approved as of the date of enactment of this section for the state or government

- The chief executive officer of the local government must certify the expenditures incurred are for the specified expenditures listed above in number #2.

- WARNING: If the State of California determines that you failed to comply with the requirements, the amount granted to you will be booked as a liability. This means the grant will turn into a loan and will be due to the Federal Government.

- Submit the certification no later than April 17, 2020

SUBMITTING THE APPLICATION

When you click on the website, the left column will give you an overview of the steps. These steps include:

- GENERAL INFORMATION

- RECIPIENT INFORMATION

- RECIPIENT TYPE

- FINANCIAL INSTITUTION INFORMATION

- CERTIFICATION

GENERAL INFORMATION

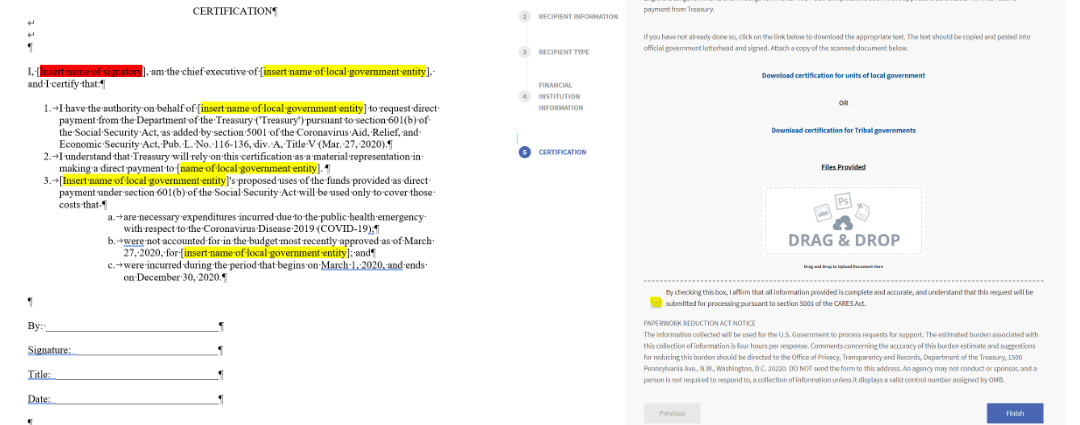

I went through each of the steps. In step #1, simply download the certification. Make sure you download the correct word document. I highlighted in red where you should insert the name of the ‘Chief Executive Officer’. The yellow highlight designates where you need to insert your local government’s name.

RECIPIENT INFORMATION

The second window is asking for the following: Recipient Name, Taxpayer ID Number, DUNS Number, Address, City, State, Postal Code, Name of authorized representative, title of representative, and contact person’s name, contact person’s title, contact person’s phone number, and contract person’s email.

RECIPIENT TYPE

Choose the type of government. Unless you are a State, Territory, or Tribal government, most likely you are considered a local government (IE county, city, JPA, special district

FINANCIAL INSTITUTION INFORMATION

Enter the ‘routing transit number (wire)’, routing transit number (ACH), account number, and financial institution name, address, and telephone number.

CERTIFICATION

Please upload the ‘certification’ doc that you downloaded in the general information section. Click the box that affirms the information provided is complete and accurate.

TIPS TO RECORD THESE COVID TRANSACTIONS

An excellent idea is to treat these funds as any other federal grant revenue. Make sure your financial management system allows you to do the following:

- Identify covid grant funds and related expenditures

- Records that identify adequately the source and application of funds (make sure vendor invoices and other documentation reconcile to your books. Document the authorization of the revenues and expenditures

- Create effective controls over and accountability for these transactions

- Compare actual results to projected incurred expenditures specific to these types of expenditures

- Create a procedure (with board approval) for determining the allowability of costs

Although you don’t necessarily need everything to be in a computer system or software, utilizing technology is the most efficient way to comply with these suggestions. At the end of the day (so to speak), make sure the accounting system will use different classes or divisions to separate the grant award revenues and expenditures to the revenues and expenditures not relating to the award. The federal government does not require a certain type of software but does specify the financial management system needs to provide the information shown above.

A sound financial management system keeps the entity organized and with sound internal controls provides the entity with the confidence the financial reports are accurate.

Remember to document and retain the supporting documents and financial reporting, because, if the State of California determines your local government was not compliant with the requirements, your grant will be reclassified as a liability. This means you will owe that money back to the federal government.

A clean set of books in addition to strong internal controls will go a long way when you are trying to prove the expenditures are compliant with the requirements. If you simply treat these funds like any other type of federal grant you should have no problem proving the incurred expenses are in compliance with the requirements of the stimulus bill.

FINAL THOUGHTS

In conclusion, if your local government is incurring extra costs due to Convid-19 and have a population of over 500,000, I would strongly urge you to consider applying for the funds. What is the worst that can happen? They say no. This stimulus package will help you pay for needed expenditures, and it will help those in your community that are hurting as well. It is a win win in my opinion. Make sure you apply by Friday, April 17, 2020 no later than 9 PM.

If you would like to speak with me, I am available. Please email me at david@dfarnsworthcpa.com or call me at (408) 780-2236. Have a great day!

David Farnsworth, CPA

P.S. We are on a mission to help local governments with fraud prevention and governmental finance. We exist to help eliminate abuse, wasteful spending and fraud. Our goal is to help you run a transparent financially responsible District or Agency. When you’re ready, here are a few ways we can help right away:

- Sign-up to our monthly newsletter here. We cover topics ranging from fraud prevention, financial reporting, government budgeting, etc.

- Take our fraud risk assessment (link to assessment here) We’ll give you specific recommendations on how to improve your situation right away.

- Receive our free fraud prevention package (click this link to schedule a meeting)

- Jump on a video conference call to get specific fraud prevention recommendations (click this link to schedule a meeting).

- Request a proposal to perform the financial audit. request for proposal.